We have pleasure in forwarding herewith the above policy document comprising of Part A to Part G

alongwith Customer Information Sheet (CIS), Benefit Illustration and Need Analysis documents.

We would also like to draw your kind attention to the information mentioned in the Schedule of the Policy

and the benefits available under the Policy.

Some of our plans have certain options (including rider(s)) available under them. It is important that the

options, if any, available under this plan and mentioned in the policy document are noted carefully as it will

be helpful to you, in case you decide to exercise any of the available options. It is also essential to note that

such option, if available and mentioned in the document of this plan has to be exercised in the right manner

and during the stipulated time limit as prescribed herein.

Free Look Period

We would request you to go through the terms and conditions of the Policy and in case you disagree with

any of the terms and conditions, you may return the Policy within a period of 30 days from the date of receipt

of the electronic or physical mode of the policy document, whichever is earlier, stating the reasons for your

objections and disagreement. On receipt of the policy we shall cancel the same and the amount of premium

deposited by you shall be refunded to you after deducting the proportionate risk premium (for Base

Policy and rider(s), if any) for the period of cover and charges for medical examination(including

special reports, if any) and for stamp duty.

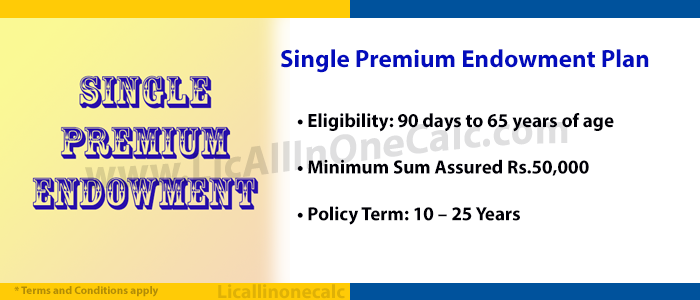

Key points about Single Premium Plan age limits:

- Minimum age: Most insurers set the minimum entry age at 18 years old.

- Maximum age: The maximum entry age is typically around 65 years old.

- Variations by insurer: Specific age limits can vary slightly depending on the insurance company and the particular single premium plan.